Laboratory of Energy Economics and Environmental Management

Established in 2017, EEEM Laboratory is the first and by far the only effort in Hong Kong S.A.R. dedicated to economic analysis of energy and environmental issues.

EEEM focuses on two broad fields: Sustainability and Productivity. In Sustainability, we study how to achieve sustainable economic growth, how to set up fine institutions to support sustainable development, and how to design environmental regulations for Sustainability. In Productivity, we answer research questions related to Productivity and Efficiency, with particular interest in energy use, the carbon market, and the water sector.

EEEM is an international team with researchers from various educational backgrounds, including economics, management, public policy, engineering, and governance. EEEM extends its presence in different continents through its strong international collaborations.

Call for Ph.D. Applications

The E3M laboratory is inviting applications from highly motivated individuals interested in

pursuing a Ph.D. degree.

Our research endeavors revolve around cutting-edge fields,

including Energy and Sustainable Development, Green Business and Finance, Climate

Change and Economic Growth, Environmental Management, and Sustainable Development

Strategies.

We offer a stimulating and collaborative research environment, providing ample

opportunities for academic growth and professional development.

Prof. Zhang Lin Interviewed by CGTN's “Climate Watch” Program

Recently, Prof. Zhang Lin was interviewed by the Climate Watch program of China International Television (CGTN) and discussed in depth about energy transition and sustainable development. This episode of the program, “Is Your Home Stove a Climate Issue? focuses on the intrinsic connection between individual lifestyles and the SDGs. [Mar.2025]

Call for Economic PhD application (Fully Funded)

The University Savoie Mont Blanc (France) seeks candidates for a funded PhD analyzing the geopolitics of critical raw materials in supply chains, supervised by Prof. Aude Pommeret and Prof. Lin Zhang. Includes access to ANR’s €75M PEPR Subsoil program, international collaborations, and potential research stays in Hong Kong. [Mar.2025]

The 48th IAEE International Conference

The 48th IAEE International Conference will be held in Hong Kong SAR in the summer of 2027 with a theme of Reshaping Energy for the Future.

E3M Seminar #10: Is Bitcoin a Climate Killer? A Critical Examination of the Proof-of-Work Paradigm

Professor Aaron Praktiknjo, Head of the Department of Energy Systems Economics at RWTH Aachen University, will visit CityUHK to deliver a seminar titled "Is Bitcoin a Climate Killer? A Critical Examination of the Proof-of-Work Paradigm" on March 28, 2025 (Friday). Join us at Y5-305, YEUNG KIN MAN ACADEMIC BUILDING to explore this pressing interdisciplinary issue. All are welcome!

E3M Seminar #9: Data Science in a Math-Less Digital Society

Wolfgang Karl Härdle, Ladlislaus von Bortkiewicz Professor of statistics, from the School of Business and Economics, Humboldt-Universität zu Berlin, will visit CityUHK to deliver a seminar titled "Data Science in a Math-Less Digital Society" on February 25, 2025. All are welcome!

E3M Pre Series 5: Polarizing Trend on Coal Power Growth Coupled with Foreign Investments Amid Global Climate Policy Shifts

Xinya Hao from E3M will share his working paper about FDI and phasing out coal-fired power plants.

Energy-poverty-inequality SDGs: A large-scale household analysis and forecasting in ChinaNew

Proc. Natl. Acad. Sci. U.S.A., Dec'2024

Cong Li, Minglai Li, Lin Zhang, Qiang Li, Hua Zheng, Marus W. Feldman

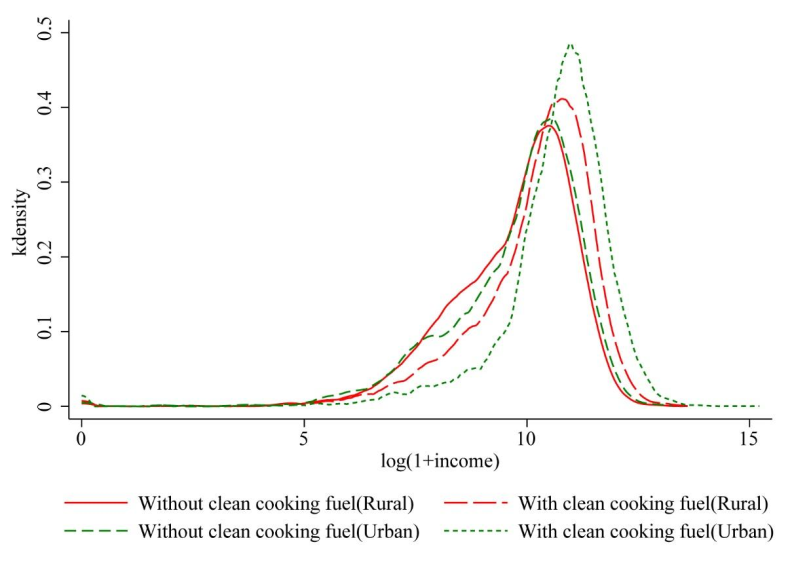

Affordable and clean energy, eliminating poverty, and reducing inequality are important goals of the United Nations Sustainable Development Goals (SDGs). This paper examines the role of access to clean cooking fuels in promoting income growth and reducing income inequality. Using data from Chinese households, we show that a 10% increase in the penetration of clean cooking fuels would result in an increase in total annual household income of US$37 billion nationwide. Income growth from access to clean cooking fuels is greater for lower-income groups due to a shift to higher household incomes and reduced downward household income mobility, which contributes to a reduction in income inequality. The effect of access to clean cooking fuels on household income growth is primarily driven by improved health and increased labor supply. The use of clean cooking fuels also saves fuel collection time and cooking time, reducing time spent on household chores by about 0.4 hours per day, thereby increasing labor supply in the job market and improving wage income. Improvements in income due to clean cooking fuels are influenced by external conditions, urbanization, education, employment opportunities, and good market conditions. With further promotion of clean cooking fuels, household income and inequality in China are expected to improve further by 2030 and contribute more widely to enhanced human well-being and achievement of the SDGs.

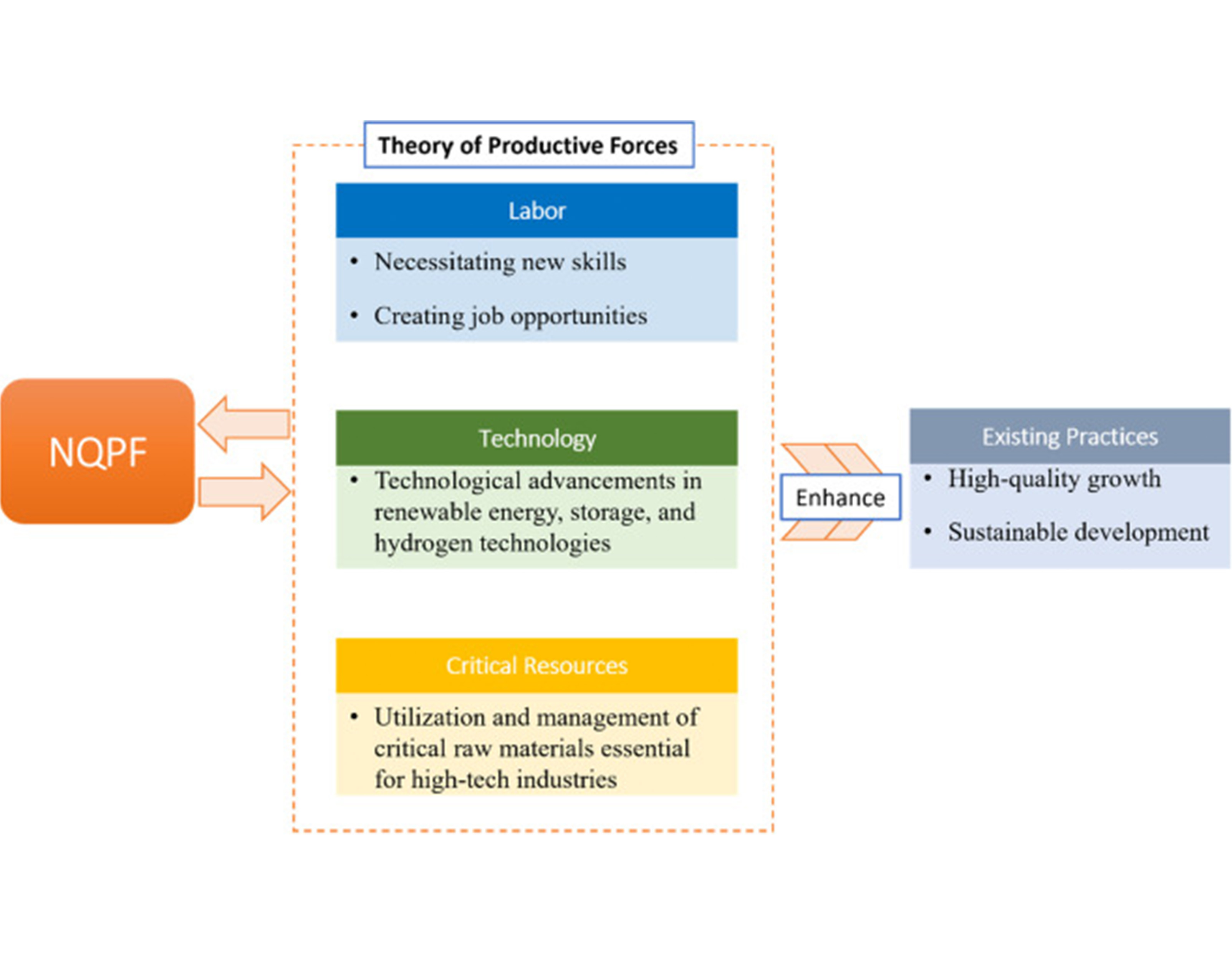

Understanding the new quality productive forces in the energy sectorNew

J. Nexus., Dec'2024

Lin Zhang

The introduction of the term “new quality productive forces” (NQPF) in China signals its move towards cutting-edge technologies and innovation as the new drivers of economic growth. As it shifts from labor-tensive sectors towards advanced industries, the energy sector is also expected to experience significant regime switch. This paper discusses how the new term articulated by the top leadership will reshape China’s energy sector including its labor, technology, critical resource supply, and the industrial value chain. Overall, the energy sector is the key domain for creating NQPF for high-quality economic growth and the new forces act as a significant catalyst in transforming the energy sector towards achieving green, low-carbon, and sustainable development.

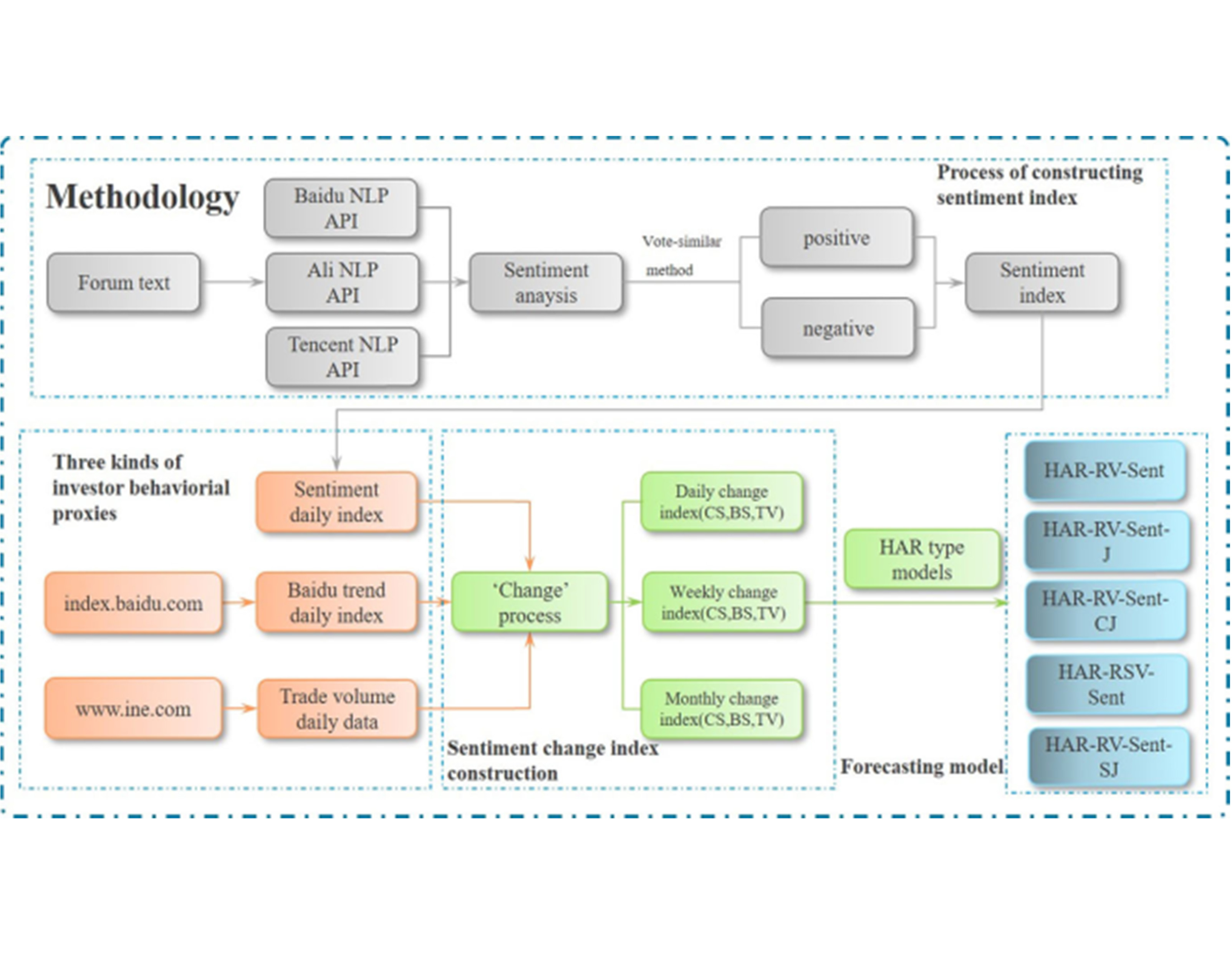

Integrating sentiment information for risk prediction: the case of crude oil futures market in China

Empir. Econ., Nov'2024

Zhe Jiang, Yunguo Lu, Lin Zhang

This paper incorporates investor sentiment indexes into the traditional standard heterogeneous autoregressive (HAR) model to improve its power on predicting crude oil futures risk. Using the 5-min high-frequency trading data to construct the daily realized volatility, the original and revised HAR models are used for in-sample regression and out-of-sample forecasting on a daily, weekly, and monthly basis. The results show that the sentiment indexes and the search trend contain incremental information for forecasting the realized volatility of INE crude oil futures in the short and medium term. The search volume is the best indicator for weekly risk forecasting of INE crude oil futures. No robust index can improve the performance of HAR-type model on long-term risk prediction. This paper thus highlights that market participants should select appropriate strategies to minimize risk when volatility is at stake for their decisions.

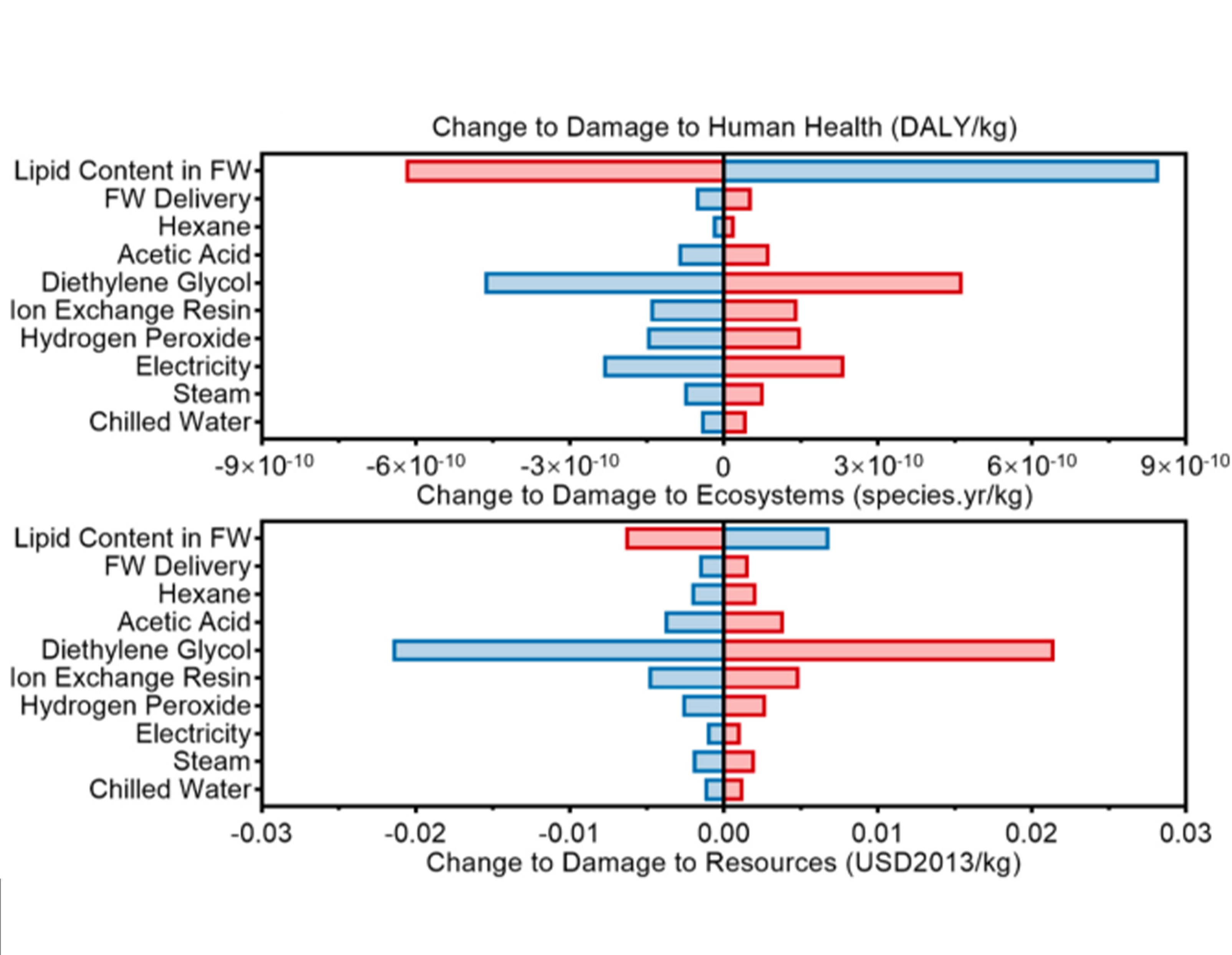

Environmental benefits of valorising food waste into bio-based polyols for the production of polyurethane rigid foams

Sustain. Prod. Consum., Nov'2024

Zi-Hao Qin, Anda Fridrihsone, Liang Dong, Jin-Hua Mou, Yahui Miao, Lin Zhang, Chunbao Xu, Mikelis Kirpluks, Carol Sze Ki Lin

In this work, we examined the environmental performance associated with the production of PURF using polyols derived from a FW biorefinery scheme by life cycle assessment (LCA). In general, FW-derived PURF leads to environmental benefits compared to fossil-based ones. Through the systematic examination of FW-derived polyols and PURF, this study demonstrated that FW-derived PURF could benefit the sustainable development of FW biorefineries and bio-based plastic industries, while the identified environmental hotspots need to be further studied and replaced with greener substitutes.

Revisiting the relationship between ESG, institutional ownership, and corporate innovation: An efficiency perspective

Corp. Soc. Responsib. Environ. Manag., Nov'2024

Qiang Li, Minglai Li, Lin Zhang

This paper investigates how environmental, social, and governance (ESG) efficiency impacts corporate innovation, highlighting its role as a crucial indicator of resource utilization within firms. Analyzing data from A-share listed companies in China between 2009 and 2021, we find that ESG efficiency levels are positively correlated with corporate innovation outputs. This indicates that higher ESG efficiency contrib- utes to greater innovation. Our result also reveals that the relationship between ESG efficiency and corporate innovation is moderated by the firm's ownership structure. Specifically, the negative moderating effects of ownership are more pronounced in regions with lower economic development or stringent environmental regulations. Technology-based firms are particularly affected, exhibiting greater vulnerability to these negative effects. These findings confirm that ESG efficiency is a significant mechanism linking ESG practices to enhanced innovation capabilities.

Working Papers

High Temperature, Power Rationing, and Firm Performance

Xinya Hao, Yongying Huang, Lin Zhang

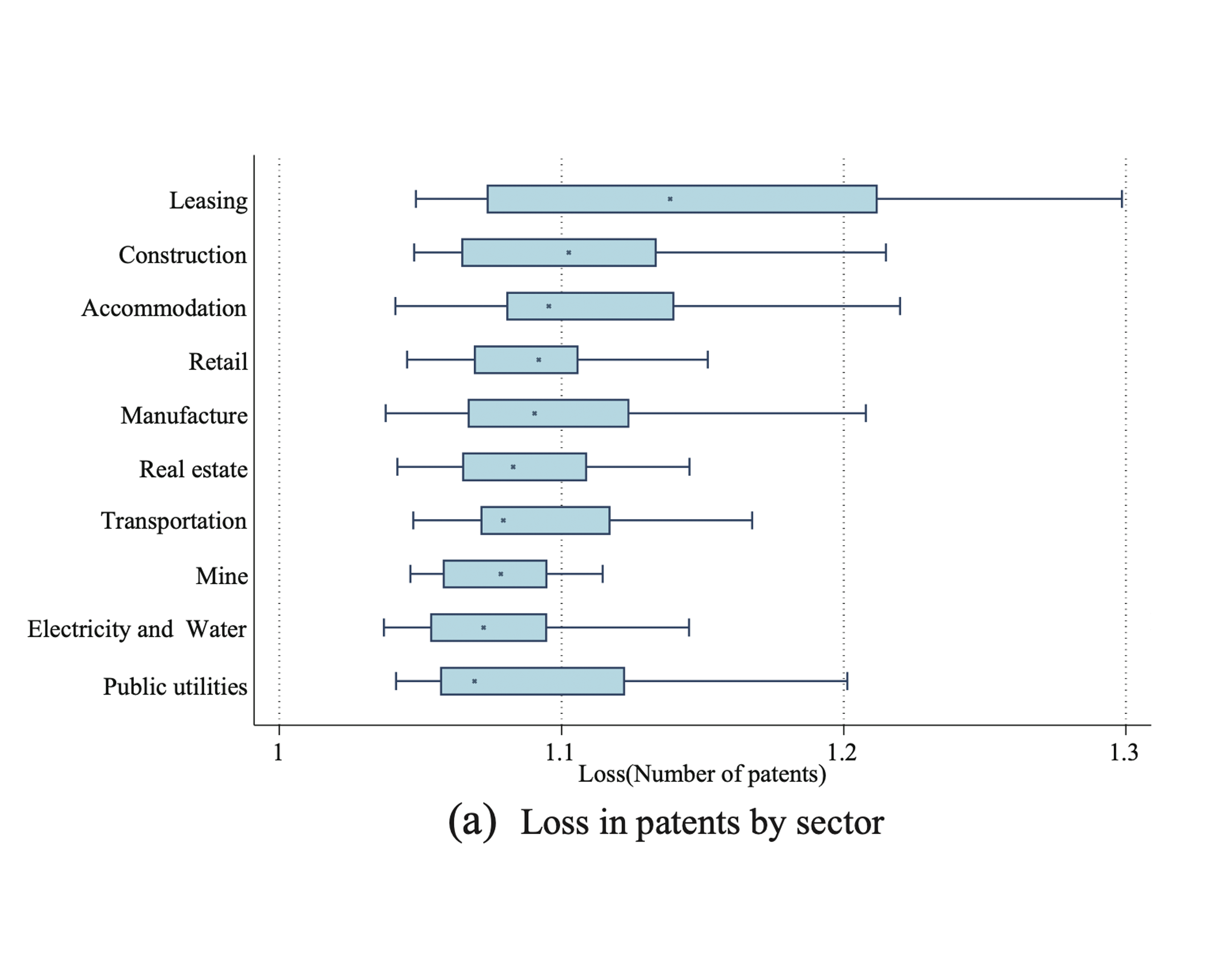

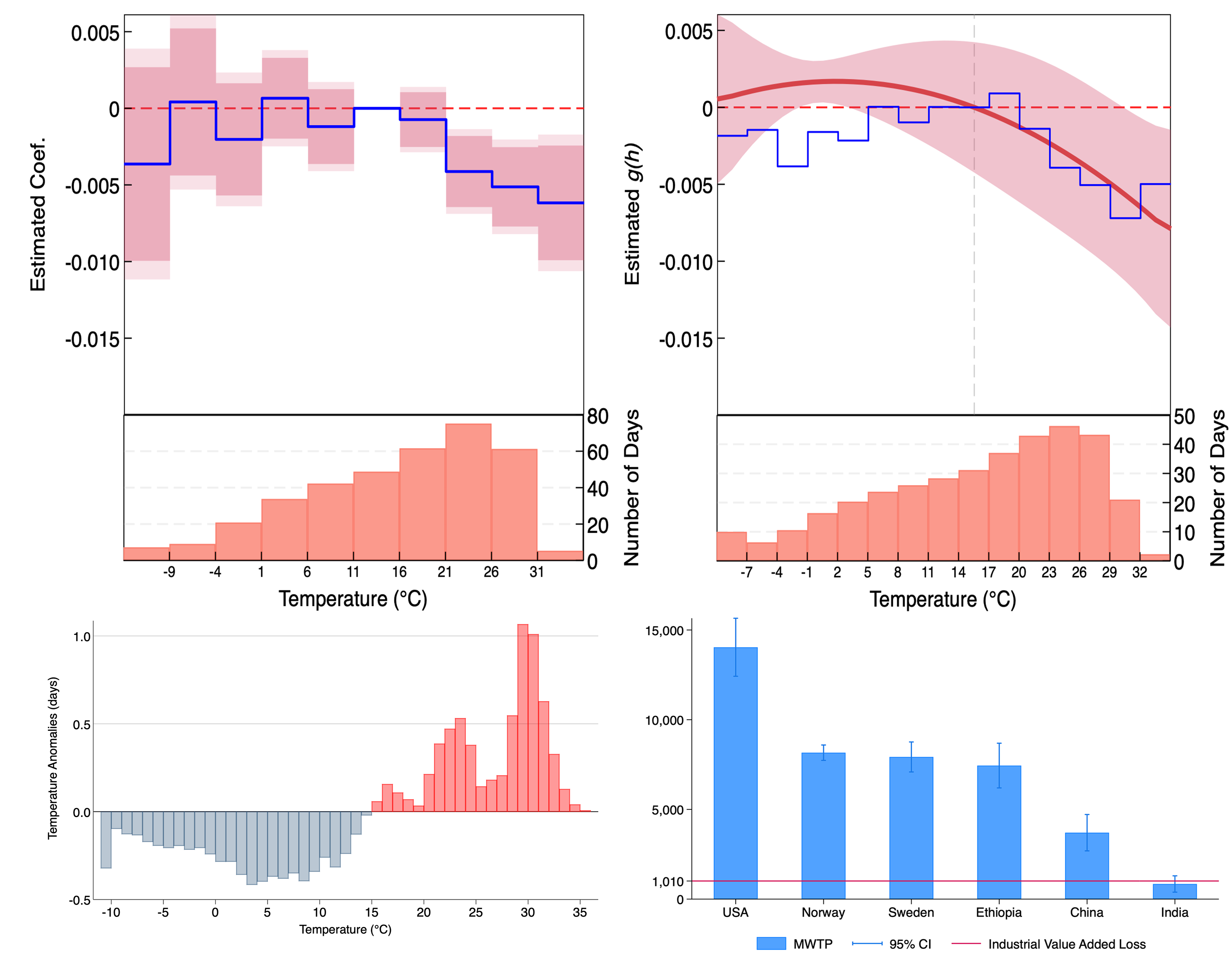

This paper investigates the impacts of power rationing on firm performance during heat-induced power shortages and the economic rationales for the government's power rationing strategy in a system characterized by a lack of market mechanisms and price signals. We combine panel data from Chinese firms with fine-scale meteorological data to find robust evidence that high temperatures significantly reduce firms' electricity usage and performance. Leveraging interprovincial hydropower dispatching and precipitation anomalies, we provide causal evidence that the decline in firms' electricity usage is primarily driven by power rationing during high-temperature days. We further developed a framework to theoretically and quantitatively analyze the social planner's optimal allocation of electricity between sectors and the welfare implications of prioritizing the household sector's power demand. Our results provide insights that climate change-intensified inter-sectoral competition for electricity and market inefficiencies can explain power rationing in China.

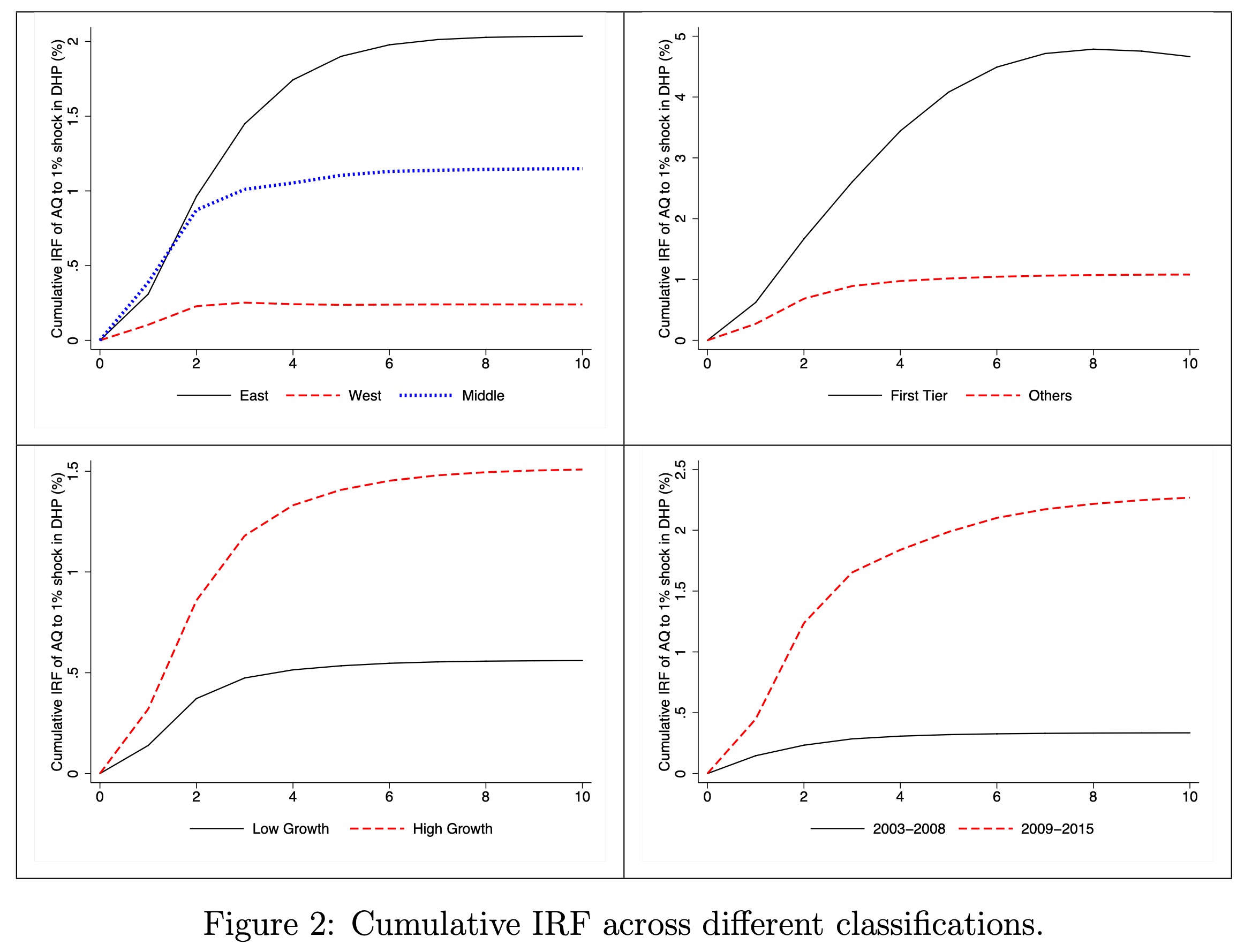

Public and Private Provision of Clean Air: Evidence from Housing Prices and Air Quality in China

Lin Zhang, Huanhuan Zheng

This paper explores the dynamic interaction between housing prices and air quality in a growing economy with changing preferences using panel vector auto-regression. We document robust evidence that better air quality is rewarded by the market with higher housing prices and that faster housing price growth in turn contributes to further air quality improvements.

- All

- 笔墨之林/学林问道

- E3M Reserach Ariticles

- Journal Abstracts

Lin Zhang

Associate Professor

Wei Jin

Research Associate

Minglai Li

Joint Ph.D. Candidate (CityU-XJTU)

Zekai Ni

Ph.D. Candidate

Xinya Hao (Hall)

Ph.D. Candidate

Qiang Li

Ph.D. Candidate

Lidong Chen

Joint Ph.D. Candidate (CityU-UCAS)

Ao Sun

Joint Ph.D. Candidate (CityU-RUC)

Guanru Zhang (Crystal)

Co-supervised Ph.D. Candidate (PIA)

Yun Qiu

Co-supervised Ph.D. Candidate

Anlan Lin

Ph.D. Student

Yao Tang

Joint Ph.D. Student (CityU-RUC)