First quantitative characterisation of the guarantee network’s evolution in a financial crisis

As COVID-19 continues to rage, the pandemic is not just a public health crisis; it has also severely affected the global economy and financial markets, which could trigger another financial crisis. In the face of acute challenges, what can we learn from history? Researchers from the School of Data Science, City University of Hong Kong (CityU) and the Academy of Mathematics and Systems Science, Chinese Academy of Sciences examined the impact of the last global financial crisis and China's economic stimulus programme on the financial system. Using real-world data, they modelled and characterised the evolution and dynamics of the whole guarantee network for the first time, in order to better understand the potential systemic risks caused by firms’ failures. Their findings are particularly valuable in today’s situation.

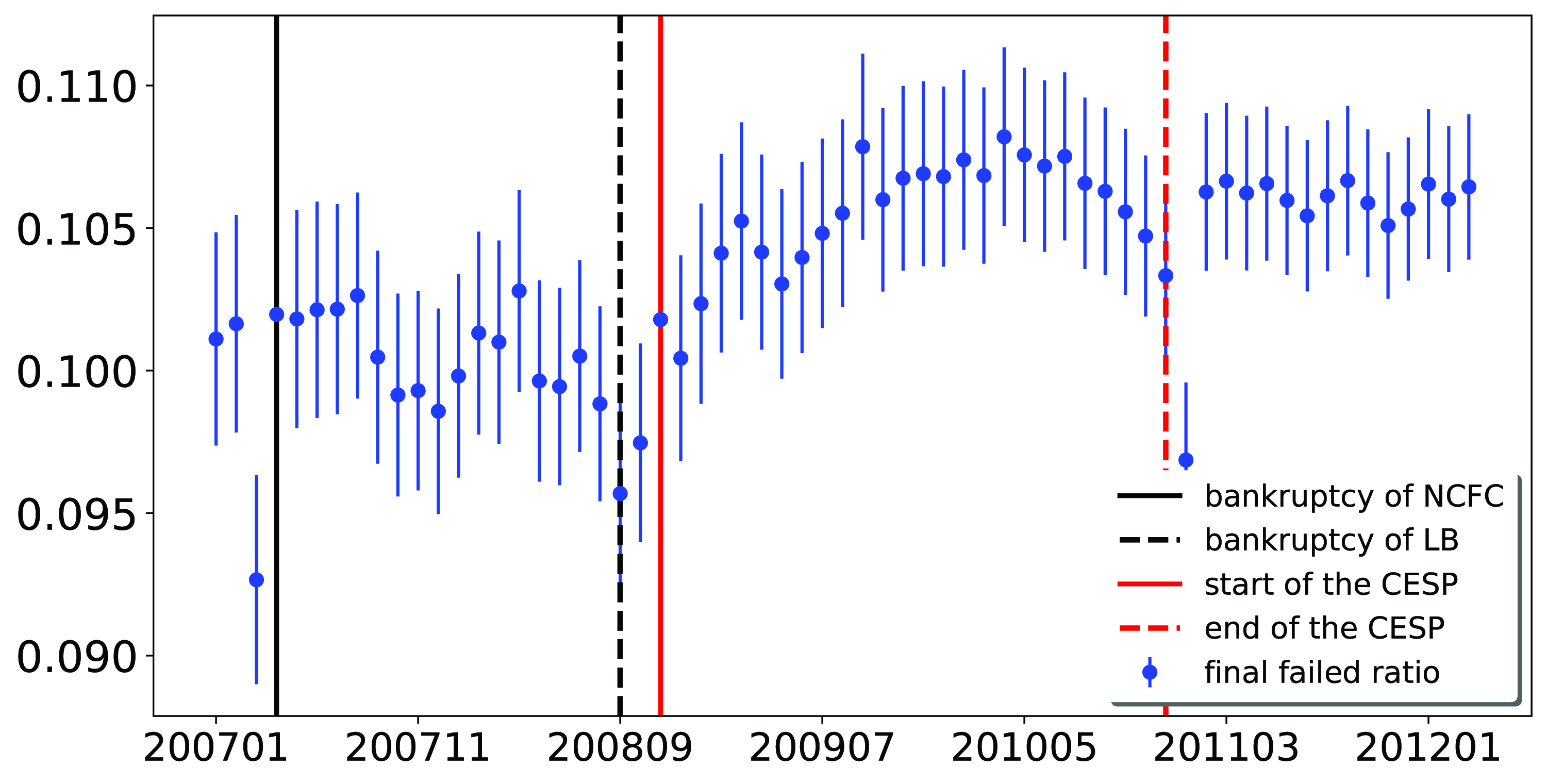

In April 2007, New Century Financial Corporation (NCFC), the US second-largest subprime mortgage lender filed for bankruptcy protection. Its demise was an early contributor to the subprime market meltdown. In September next year, the collapse of Lehman Brothers, the fourth largest US investment bank triggered the financial tsunami that swept the world. In order to alleviate the effects of the crisis on China’s economy, the Chinese government introduced ten measures to expand domestic demand and promote economic growth, known as the four trillion stimulus package. When the crisis began to subside, monetary policies were changed, including raising the reserve requirement ratio and interest rates, to regulate the debt behaviour.

The credit market is the core of China’s financial system. With his collaborators, Dr Zhang Qingpeng, Assistant Professor of CityU’s School of Data Science focused the research on the guarantee network, drawing upon five-year loan guarantee data to examine how the financial crisis and the corresponding policy measures affected the stability of the financial system.

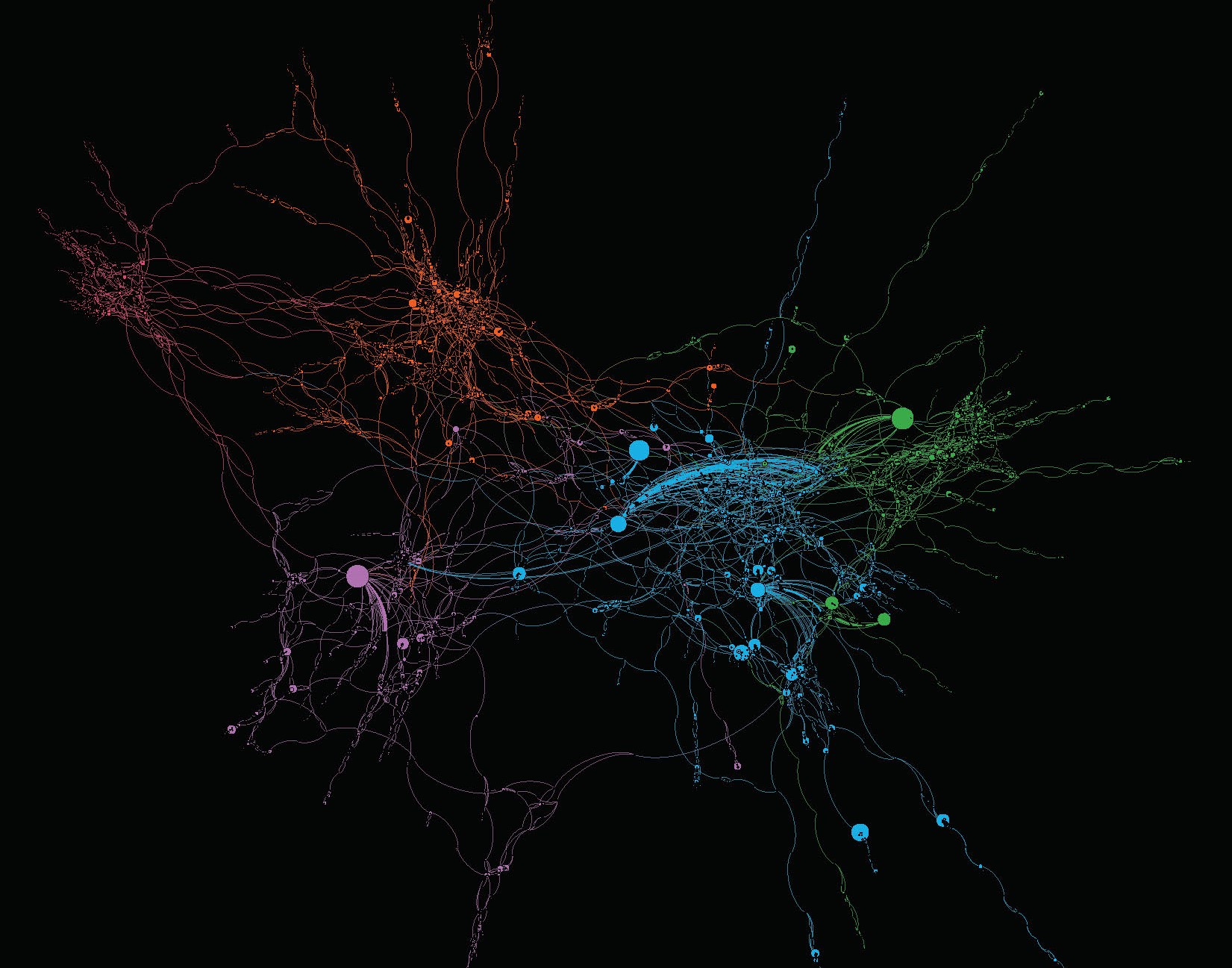

Network science, a powerful tool for finance research, has been applied extensively to analysing the global banking system, international financial network, and interlocking boards of directors. And guarantee relationships among firms can be naturally represented as networks.

What is a guarantee network?

A financial network consists of a collection of entities, such as firms and banks, linked by mutually beneficial business relationships. A guarantee relationship between two firms means that the guarantor has to assume the debt obligation if the borrower fails to repays the loan.

Through analysing the guarantee networks formed by guarantee relationships, researchers can better understand the evolution of the credit system in downturn period and identify the potential systemic risks. Yet, related studies have been focused on theoretical or small-scale data analysis.

This research is unique, as it represents the first effort to quantitatively characterise the evolution of the entire guarantee network. The team divided the data from January 2007 to March 2012, which account for nearly 80% of total domestic monthly loans, into three phases: first, the global financial crisis; second, the implementation of the stimulus programme; and third, the subsequent monetary policy adjustment. They went beyond aggregated statistics, and used a complex network approach and exponential random graph models (ERGM) to model the guarantee relationships among firms. That enabled them to capture the dynamics and patterns of the guarantee network in high granularity.

Evolution of the guarantee network in three phases

The team discovered that:

(1) as many firms went bankrupt during the financial crisis, the size of the guarantee network became smaller and less connected, but its stability increased with the surviving and robust firms;

(2) following the implementation of the stimulus programme, mutual guarantees between firms were encouraged. The guarantee network expanded rapidly but became more fragile;

(3) as the policy adjustments strengthened credit discipline and constrained the mutual guarantee behaviour, the resilience of the guarantee network was gradually enhanced.

The team illustrated the underlying logic of the guarantee network’s evolving stability. While the financial crisis had a huge impact on the economy, unqualified firms were knocked out, thereby enhancing the stability of the network. The stimulus programme having saved poorly-performing firms through encouraging mutual guarantee behaviour avoided instantaneous catastrophic losses, but it resulted inomaking the network fragile. In the long run, this might lead to domino-like cascading failures in the financial system. But the subsequent policy adjustments regulated the debt behaviour and restored the stability of the network. The research confirms that the Chinese government’s response to the last global financial crisis was timely and appropriate.

Saving firms or maintaining a good resilience of the guarantee network

By highlighting the trade-off between preventing short-term catastrophic losses and maintaining long-term system stability, this study offers a new perspective for understanding how external shock and bailout would affect the guarantee network’s stability. That could help decision makers develop effective strategies to respond to crisis. “We have recently witnessed large-scale crises and emergencies, such as the global pandemic and changing dynamics in the international arena. We need to learn from history so that we are well prepared for the next financial crisis,” said Dr Zhang Qingpeng.

The research, conducted by Dr Zhang, as well as Dr Yang Xiaoguang and Dr. Wang Yingli of the Academy of Mathematics and Systems Sciences, Chinese Academy of Sciences, was published in Nature Communications recently, titled "Evolution of the Chinese guarantee network under financial crisis and stimulus program". Dr Wang was a PhD student jointly supervised by Dr Zhang and Dr Yang.

DOI number: 10.1038/s41467-020-16535-8